Ind AS 23, Borrowing Cost, Important Questions with Solutions for CA Final Financial Reporting May & Nov 2021 Exams

Question 1 –

An entity constructs a new head office building commencing on 1st September 20X1, which continues till 31st December 20X1. Directly attributable expenditure at the beginning of the month on this asset are Rs. 100,000 in September 20X1 and Rs. 250,000 in each of the months of October to December 20X1.

The entity has not taken any specific borrowings to finance the construction of the asset, but has incurred finance costs on its general borrowings during the construction period. During the year, the entity had issued 10% debentures with a face value of Rs. 20 lacs and had an overdraft of Rs. 500,000, which increased to Rs. 750,000 in December 20X1. Interest was paid on the overdraft at 15% until 1 October 20X1, then the rate was increased to 16%.

Calculate the capitalization rate for computation of borrowing cost in accordance with Ind AS 23 ‘Borrowing Costs’.

Solution –

Since the entity has only general borrowing hence first step will be to compute the capitalisation rate. The capitalisation rate of the general borrowings of the entity during the period of construction is calculated as follows:

| Finance cost on Rs. 20 lacs 10% debentures during September – December 20X1 | Rs. 66,667 |

| Interest @ 15% on overdraft of Rs. 5,00,000 in September 20X1 | Rs. 6,250 |

| Interest @ 16% on overdraft of Rs. 5,00,000 in October and November 20X1 | Rs. 13,333 |

| Interest @ 16% on overdraft of Rs. 750,000 in December 20X1 | Rs. 10,000 |

| Total finance costs in September – December 20X1 | Rs. 96,250 |

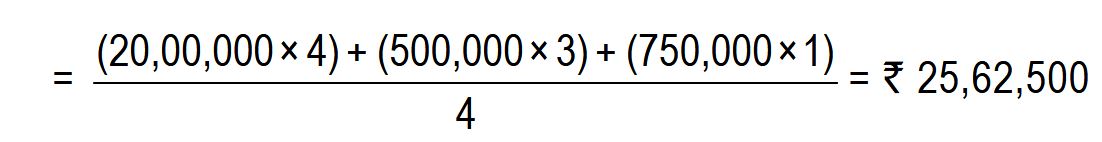

Weighted average borrowings during period

Capitalisation rate = Total finance costs during the construction period / Weighted average borrowings during the construction period

= 96,250 / 25,62,500 = 3.756%

Question 2 –

K Ltd. began construction of a new building at an estimated cost of ` 7 lakh on 1st April, 20X1. To finance construction of the building it obtained a specific loan of ` 2 lakh from a financial institution at an interest rate of 9% per annum.

The company’s other outstanding loans were:

| Amount | Rate of Interest per annum |

| Rs. 7,00,000 | 12% |

| Rs. 9,00,000 | 11% |

The expenditure incurred on the construction was:

| April, 2017 | Rs. 1,50,000 |

| August, 2017 | Rs. 2,00,000 |

| October, 2017 | Rs. 3,50,000 |

| January, 2018 | Rs. 1,00,000 |

The construction of building was completed by 31st January, 2018. Following the provisions of Ind AS 23 ‘Borrowing Costs’, calculate the amount of interest to be capitalized and pass necessary journal entry for capitalizing the cost and borrowing cost in respect of the building as on 31st January, 2018.

Solution –

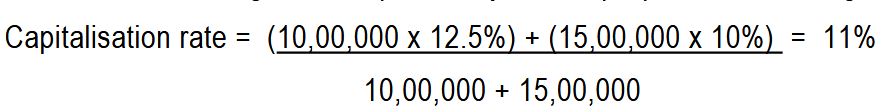

(i) Calculation of capitalization rate on borrowings other than specific borrowings

| Amount of loan (Rs.) | Rate of interest | Amount of interest (Rs.) | |

| 7,00,000 | 12% | = | 84,000 |

| 9,00,000 | 11% | = | 99,000 |

| 16,00,000 | 1,83,000 | ||

| Weighted average rate of interest (1,83,000/16,00,000) x 100 | = | 11.4375% | |

(ii) Computation of borrowing cost to be capitalized for specific borrowings and general borrowings based on weighted average accumulated expenses

| Date of incurrence of expenditure | Amount spent | Financed through | Calculation | Rs. |

| 1st April, 2017 | 1,50,000 | Specific borrowing | 1,50,000 x 9% x 10/12 | 11,250 |

| 1st August, 2017 | 2,00,000 | Specific borrowing | 50,000 x 9% x 10/12 | 3,750 |

| General borrowing | 1,50,000 x 11.4375% x 6/12 | 8,578.125 | ||

| 1st October, 2017 | 3,50,000 | General borrowing | 3,50,000 x 11.4375% x 4/12 | 13,343.75 |

| 1st January, 2018 | 1,00,000 | General borrowing | 1,00,000 x 11.4375% x 1/12 | 953.125 |

| 37,875 |

Note: Since construction of building started on 1st April, 2017, it is presumed that all the later expenditures on construction of building had been incurred at the beginning of the respective month.

(iii) Total expenses to be capitalized for building

| Rs. | |

| Cost of building Rs. (1,50,000 + 2,00,000 + 3,50,000 + 1,00,000) | 8,00,000 |

| Add: Amount of interest to be capitalized | 37,875 |

| 8,37,875 |

(iv) Journal Entry

| Date | Particulars | Rs. | Rs. | |

| 31.1.2018 | Building account | Dr. | 8,37,875 | |

|

To Bank account |

8,00,0000 | |||

|

To Interest payable (borrowing cost) |

37,875 | |||

| (Being expenditure incurred on construction of building and borrowing cost thereon capitalized) |

Note: In the above journal entry, it is assumed that interest amount will be paid at the year end. Hence, entry for interest payable has been passed on 31.1.2018.

Alternatively, following journal entry may be passed if interest is paid on the date of capitalization:

| Date | Particulars | Rs. | Rs. | |

| 31.1.2018 | Building account | Dr. | 8,37,875 |

8,37,875 |

|

To Bank account |

||||

| (Being expenditure incurred on construction of building and borrowing cost thereon capitalized) |

Question 3 –

On 1st April, 20X1, entity A contracted for the construction of a building for Rs. 22,00,000. The land under the building is regarded as a separate asset and is not part of the qualifying assets. The building was completed at the end of March, 20X2, and during the period the following payments were made to the contractor:

| Payment date | Amount (Rs. ’000) |

| 1st April, 20X1 | 200 |

| 30th June, 20X1 | 600 |

| 31st December, 20X1 | 1,200 |

| 31st March, 20X2 | 200 |

| Total | 2,200 |

Entity A’s borrowings at its year end of 31st March, 20X2 were as follows:

a. 10%, 4-year note with simple interest payable annually, which relates specifically to the project; debt outstanding on 31st March, 20X2 amounted to 7,00,000. Interest of Rs. 65,000 was incurred on these borrowings during the year, and interest income of Rs. 20,000 was earned on these funds while they were held in anticipation of payments.

b. 5% 10-year note with simple interest payable annually; debt outstanding at 1st April, 20X1 amounted to Rs. 1,000,000 and remained unchanged during the year; and

c. 10% 10-year note with simple interest payable annually; debt outstanding at 1st April, 20X1 amounted to Rs. 1,500,000 and remained unchanged during the year.

What amount of the borrowing costs can be capitalized at year end as per relevant Ind AS?

Solution

As per Ind AS 23, when an entity borrows funds specifically for the purpose of obtaining a qualifying asset, the entity should determine the amount of borrowing costs eligible for capitalisation as the actual borrowing costs incurred on that borrowing during the period less any investment income on the temporary investment of those borrowings.

The amount of borrowing costs eligible for capitalization, in cases where the funds are borrowed generally, should be determined based on the expenditure incurred in obtaining a qualifying asset. The costs incurred should first be allocated to the specific borrowings.

Analysis of expenditure:

| Date | Expenditure (Rs.’000) | Amount allocated in general borrowings (Rs.’000) |

Weighted for period outstanding (Rs.’000) |

||

| 1st April 20X1 | 200 | 0 |

0 |

||

| 30th June 20X1 | 600 | 100* | 100 × 9/12 | = | 75 |

| 31st Dec 20X1 | 1,200 | 1,200 | 1,200 × 3/12 | = | 300 |

| 31st March 20X2 | 200 | 200 | 200 × 0/12 | = | 0 |

| Total | 2,200 |

375 |

|||

*Specific borrowings of Rs. 7,00,000 fully utilized on 1st April & on 30th June to the extent of Rs. 5,00,000 hence remaining expenditure of Rs. 1,00,000 allocated to general borrowings.

The expenditure rate relating to general borrowings should be the weighted average of the borrowing costs applicable to the entity’s borrowings that are outstanding during the period, other than borrowings made specifically for the purpose of obtaining a qualifying asset.

| Borrowing cost to be capitalized: | Amount |

| (Rs.) | |

| On specific loan | 65,000 |

| On General borrowing (3,75,000 × 11%) | 41,250 |

| Total | 1,06,250 |

| Less interest income on specific borrowings | (20,000) |

| Amount eligible for capitalization | 86,250 |

| Therefore, the borrowing costs to be capitalized are Rs. 86,250. |

Question 4 –

An entity constructs a new office building commencing on 1st September, 2018, which continues till 31st December, 2018 (and is expected to go beyond a year). Directly attributable expenditure at the beginning of the month on this asset are Rs. 2 lakh in September 2018 and Rs. 4 lakh in each of the months of October to December 2018.

The entity has not taken any specific borrowings to finance the construction of the building but has incurred finance costs on its general borrowings during the construction period. During the year, the entity had issued 9% debentures with a face value of Rs. 30 lakh and had an overdraft of Rs. 4 lakh, which increased to Rs. 8 lakh in December 2018. Interest was paid on the overdraft at 12% until 1st October, 2018 and then the rate was increased to 15%.

Calculate the capitalization rate for computation of borrowing cost in accordance with Ind AS ‘Borrowing Cost’.

Solution –

Calculation of capitalization rate on borrowings other than specific borrowings

| Nature of general borrowings |

Period of outstanding Balance |

Amount of loan

(Rs.) |

Rate of interest p.a. |

Weighted average amount of interest (Rs.) |

|

a |

b | c | d = [(b x c) x (a/12)] | |

| 9% Debentures | 12 months | 30,00,000 | 9% | 2,70,000 |

| Bank overdraft | 9 months | 4,00,000 | 12% | 36,000 |

| 2 months | 4,00,000 | 15% | 10,000 | |

| 1 month | 8,00,000 | 15% | 10,000 | |

| 46,00,000 | 3,26,000 |

Weighted average cost of borrowings

= {30,00,000 x(12/12)} + {4,00,000 x (11/12)} + {8,00,000 x (1/12)}

= 34,33,334

Capitalisation rate

= (Weighted average amount of interest / Weighted average of general borrowings) x 100

= (3,26,000 / 34,33,334) x 100 = 9.50% p.a.

I have a question.

Mam/sir, if a loan taken in foreign currency , then while calculating WACR , interest cost will be taken at year end rate or average rate ?(if interest paid on yr end or if accrued only not paid on yr end)

Pingback: CA Final Financial Reporting (FR) Important Questions - CA Blog India